owner draw report quickbooks

A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners. There are two methods to Record an Owners Draw in QuickBooks.

Intuit Quickbooks Desktop Pro Plus 2021 Accounting Software For Small Business 1 Year Subscription Quickbooks Data Backup Accounting Software

It is another separate equity account used to pay the.

. When recording an owners draw in QuickBooks Online youll need to create an equity account. Via Chart of Accounts. At the bottom left-hand side of the.

First you can view the accounts balances by viewing their. To create an owners draw log into your Quickbooks account and access Lists Chart of Accounts. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here.

An owners draw is a separate equity account thats used to pay the owner of a business. 1 Create each owner or partner as a VendorSupplier. Report Inappropriate Content.

In the Account field be sure to select Owners equity you created. Choose the bank account where your money will be withdrawn. This will handle and track the withdrawals of the companys assets to pay an.

Select Print later if you want to print the check. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. To write a check from an owners equity account.

One adds one subtracts. Setting Up an Owners Draw Account. The funds are transferred from the business account to the owners personal bank.

When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the. THUS theres no such thing as an Owners Draw. The memo field is.

A members draw also known as an owners draw or a partners draw is a quickbooks account that records the amount taken out of a company by one of its owners. Fill in the check fields. We also show how to record both contributions of capita.

You can follow this article for step by step procedure to enter. Procedure to Set up Owners Draw in QuickBooks Online The Owners draw can be setup via charts of account option. There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online.

With the help of an owners draw account you are enabled to record any kind of withdrawals from the bank account. QuickBooks records the draw in an. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks.

For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership name Equity do not post to this account it is a summing. The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end. Since they are equal types then negative for draw and positive for contributions is correct.

Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Am I entering Owners Draw correctly. In fact the best recommended practice is to create an owners draw.

To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity option and. This article describes how to. The best way to do it would be to go back and change the expense account from Owners Personal Expenses to Owners Draw equity account for each transaction if there.

To tie them together we recommend you have actually 4. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

You have an owner you want to pay in QuickBooks Desktop. Details To create an owners draw account. In Q you and the business are considered to be a single tax entity if the data for both is in a single Q data file.

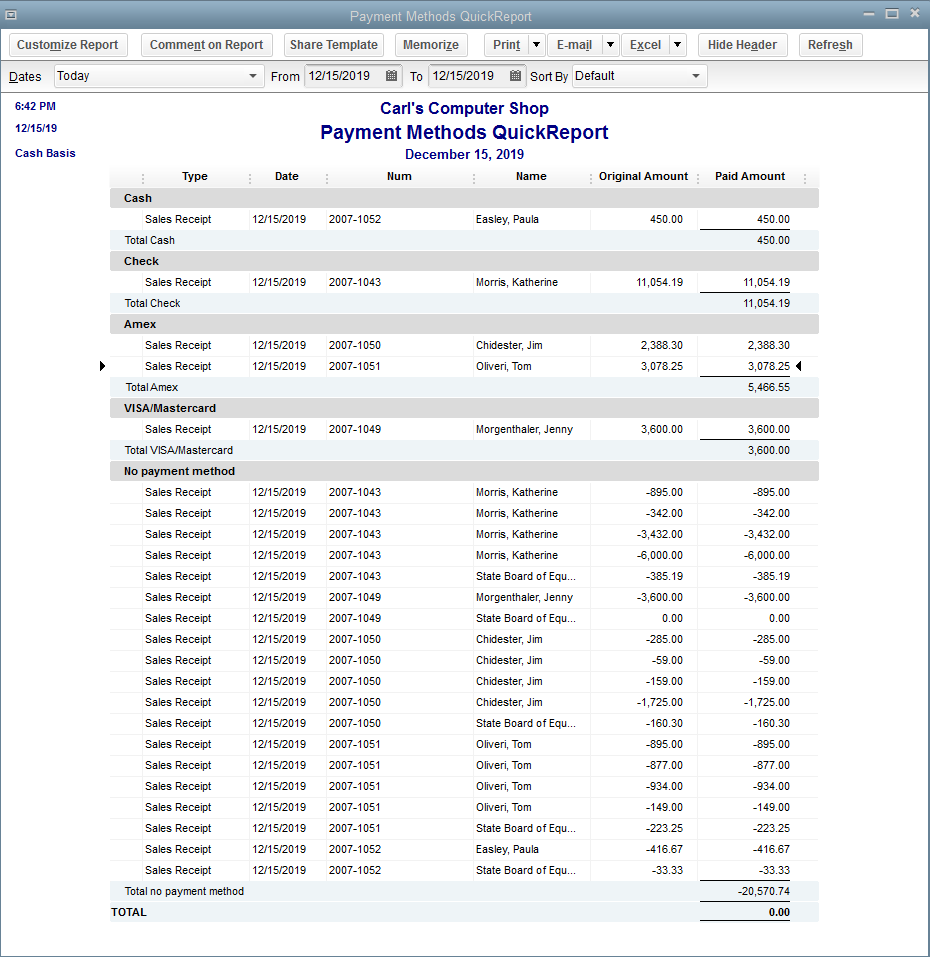

Daily Z Out Report For Quickbooks Desktop Sales Insightfulaccountant Com

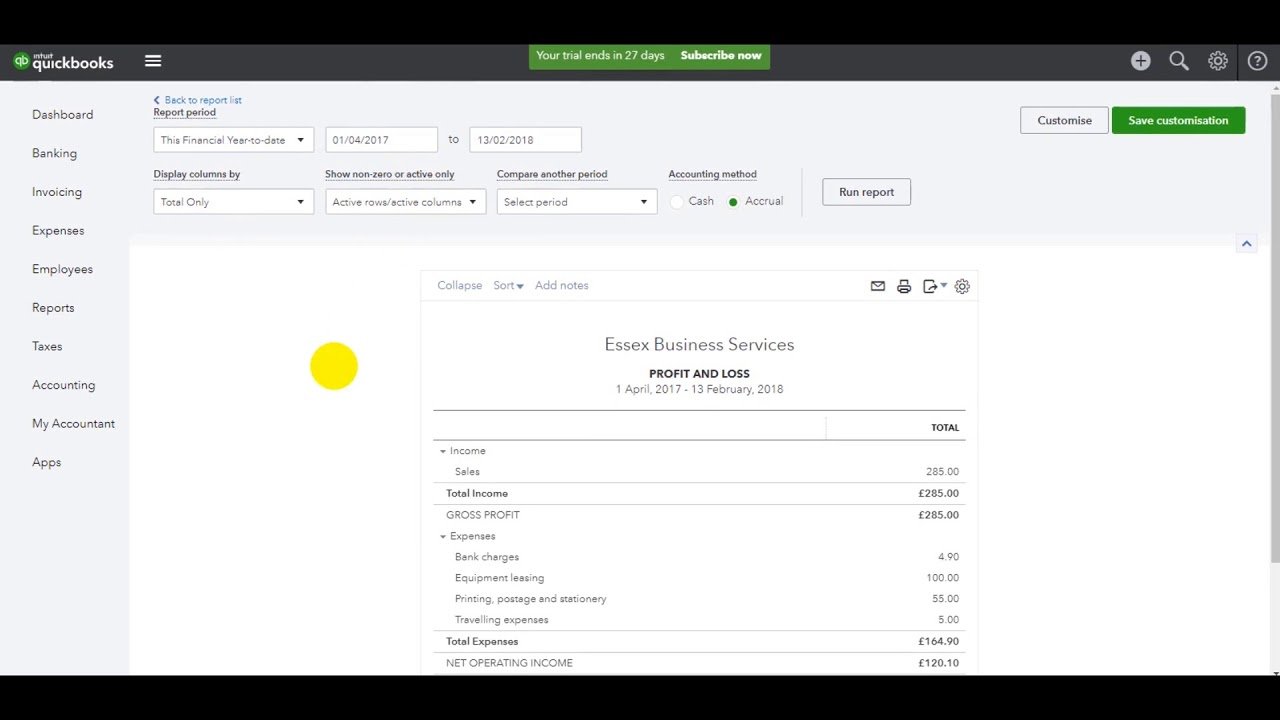

Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube

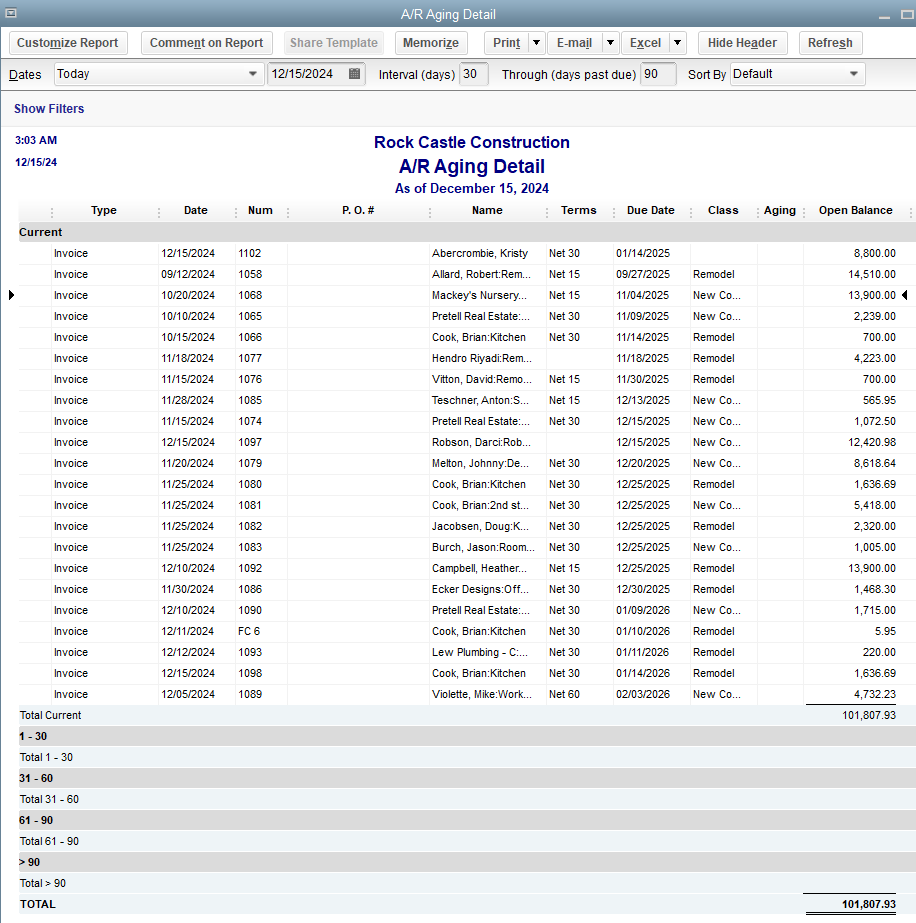

Accounts Receivable Aging Report

Creating Custom Conditional Formatting Rules In Excel Resume Words Adding Numbers Excel

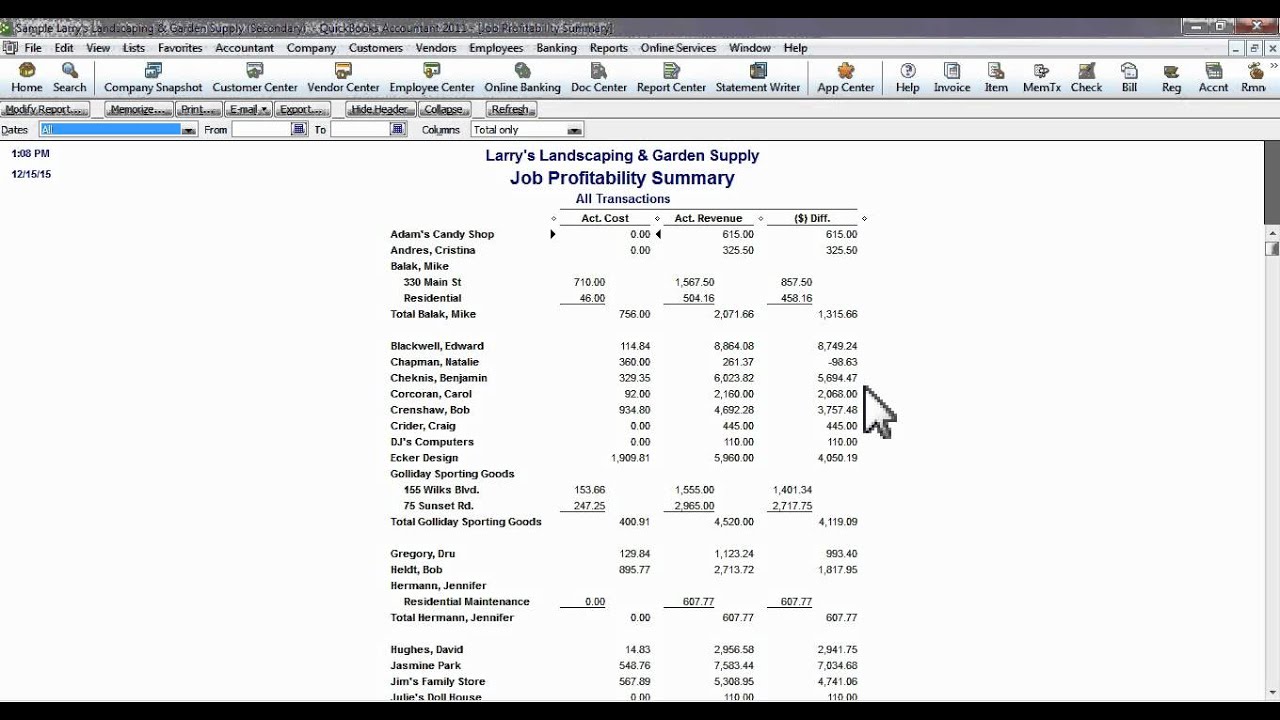

Creating Job Cost Reports In Quickbooks Youtube

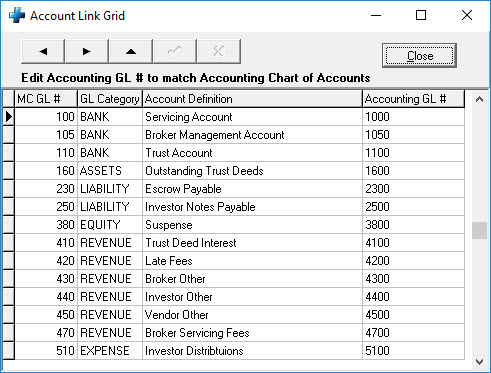

Quickbooks Accounting Integration

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

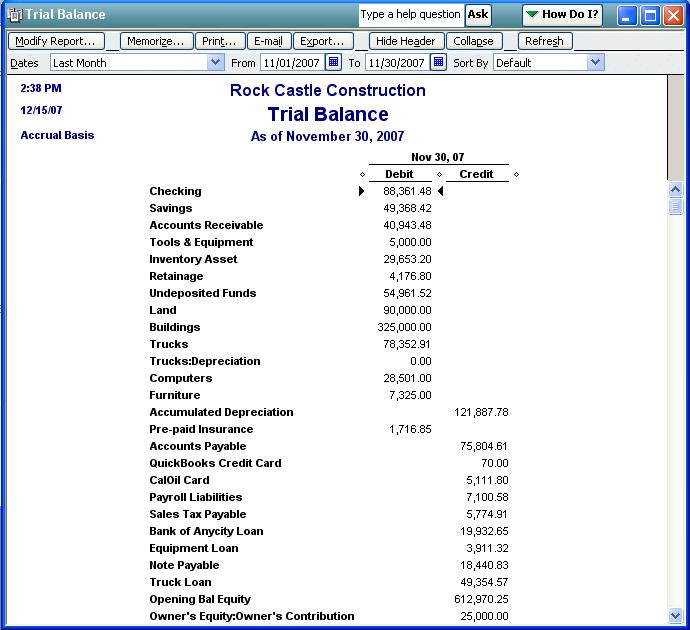

Qodbc Desktop How To Run A Trial Balance Report In Qodbc Powered By Kayako Help Desk Software

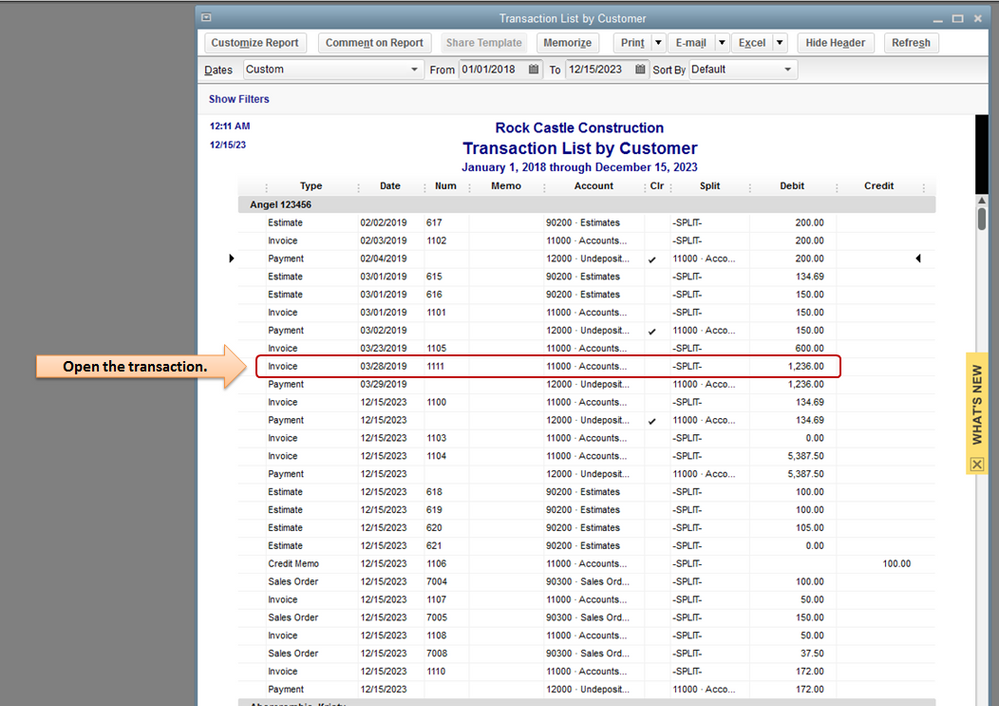

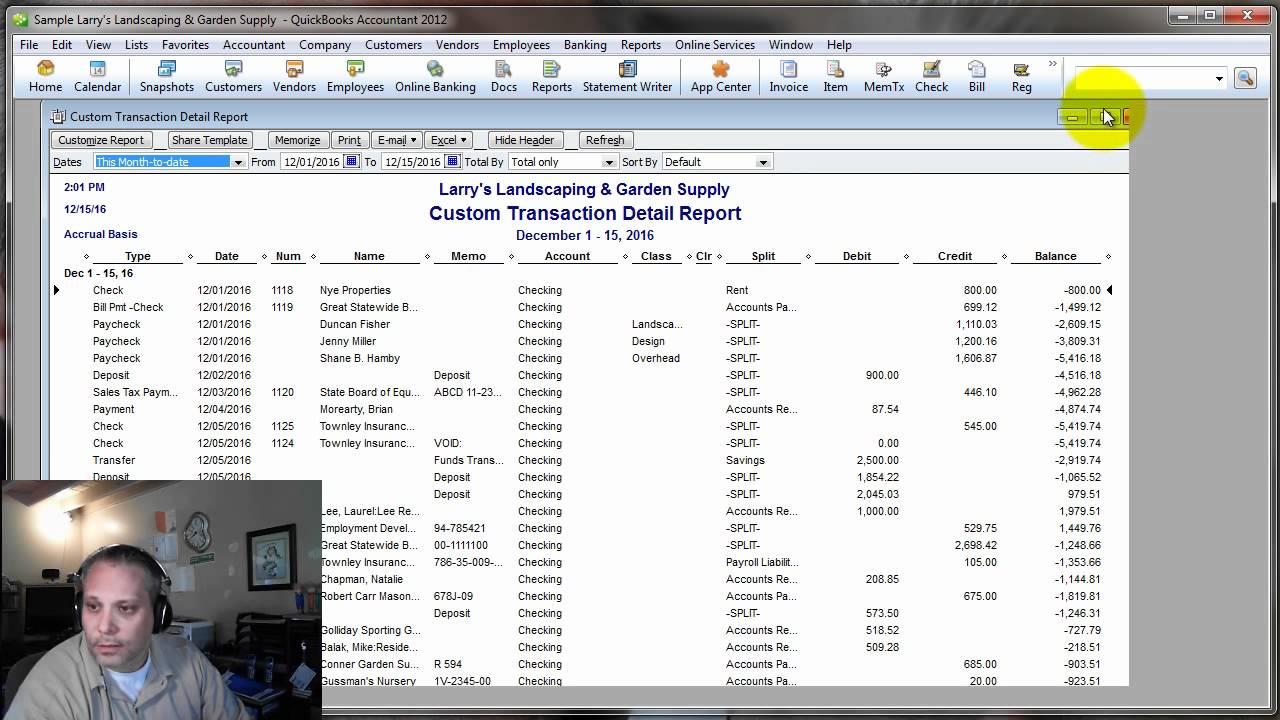

Solved Transaction Detail By Account Report

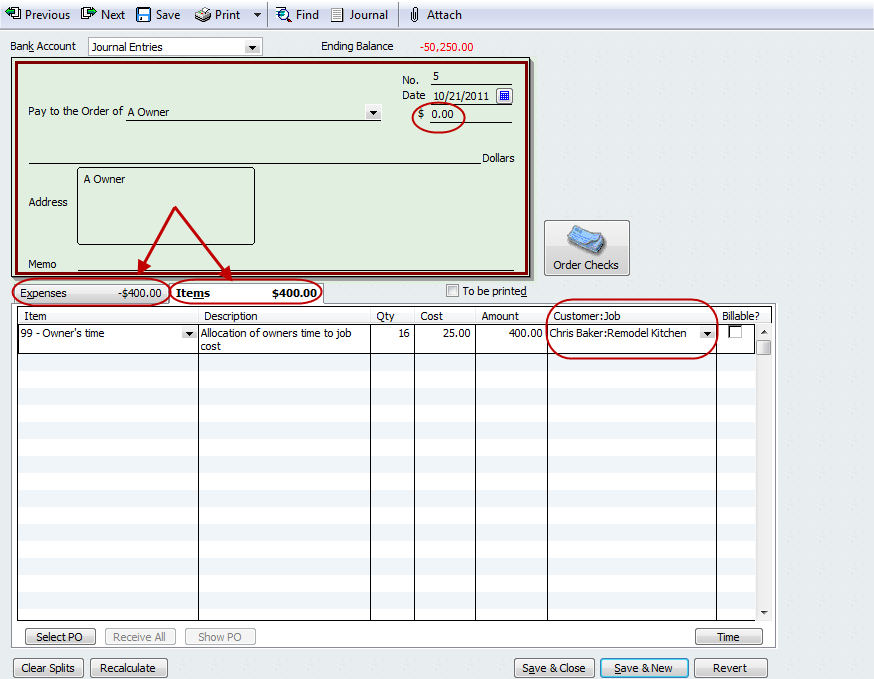

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

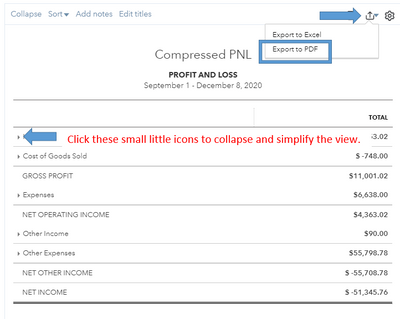

Solved Custom Profit And Loss Report

Quickbooks Help How To Create A Check Register Report In Quickbooks Youtube

What Report Will Show A What Invoices You Paid A Vendor With What Check

Quickbooks Job Costing Job Wip Summary Report Quickbooks Data Migrations Data Conversions

Ten Overlooked Quickbooks Reports That You Should Use Tax Pro Plus

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial