kentucky property tax calculator

See Results in Minutes. Find Details on Kentucky Properties Fast.

North Central Illinois Economic Development Corporation Property Taxes

The median property tax on a 9830000 house is 70776 in Kentucky.

. The median property tax on a 15920000 house is 167160 in the United States. Learn About Owners Year Built More. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

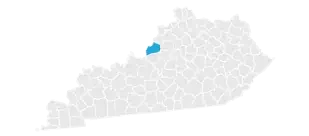

Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky. The median property tax in Grayson County Kentucky is 434 per year for a home worth the median value of 83700. The tax estimator above only includes a single 75 service fee.

For example the sale of a 200000 home would require a 200 transfer tax to be paid. Grayson County has one of the lowest median property tax rates in the country with only two thousand five hundred forty two of the 3143 counties. The tax on motor vehicles is a property tax.

When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. Under Section 172 of the Kentucky Constitution all property not exempted from taxation by the constitution is assessed at its fair cash value which is the estimated price it would bring at a fair voluntary sale. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

Grayson County collects on average 052 of a propertys assessed fair market value as property tax. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset.

Of course where you choose to live in Kentucky has an impact on your taxes. 216 rows Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats.

As is mentioned in the prior section it does not tax Social Security income. Property tax is calculated based on your home value and the property tax rate. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

Our Allen County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

1070 of Assessed Home Value. Overview of Kentucky Taxes. Based on a 200000 mortgage.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. The median property tax on a 10970000 house is 115185 in the United States. 0830 of Assessed Home Value.

0930 of Assessed Home Value. Explanation of the Property Tax Process. For most counties and cities in the Bluegrass State this is a percentage of taxpayers.

Local Property Tax Rates. Maintaining list of all tangible personal property. Actual amounts are subject to change based on tax rate changes.

All rates are per 100. It is based ONLY upon the taxes regarding inventory. On average homeowners pay just a 083 effective property tax.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Fayette County. Payment shall be made to the motor vehicle owners County Clerk. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Trigg County.

Other forms of retirement income pension income 401 k or IRA income are exempt up to a total of 31110 per person. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Ad Look Up Any Address in Kentucky for a Records Report.

Kentucky imposes a flat income tax of 5. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. The median property tax on a 10970000 house is 78984 in Kentucky.

How Your Property Taxes Compare Based on an Assessed Home Value of 250000. The median property tax on a 10970000 house is 70208 in Carroll County. Therefore the DOR Inventory Tax Credit Calculator is the.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. Todays Best 30 Year Fixed Mortgage Rates. The median property tax on a 15920000 house is 114624 in Kentucky.

The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator. Campbell County has the highest average effective rate in the state at 117 while Carter County has the lowest rate at a mere 051. The median property tax on a 9830000 house is 103215 in the United States.

The states sales tax rate is 6. Both the sales and property taxes are below the national averages while the state income tax is right around the US. Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

There are two unique aspects of Kentuckys tax system. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 20212022 tax refund. 121 rows The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083.

The tax rate is the same no matter what filing status you use. Please note that this is an estimated amount. Property taxes in kentucky are relatively low.

Yes Kentucky is fairly tax-friendly for retirees. The Property Valuation Administrators office is responsible for. It is levied at six percent and shall be paid on every motor vehicle used in.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts. Use our sales tax calculator or download a free kentucky sales tax rate table by zip code.

How Is Tax Liability Calculated Common Tax Questions Answered

Kentucky Property Tax Calculator Smartasset

Kentucky Property Taxes By County 2022

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

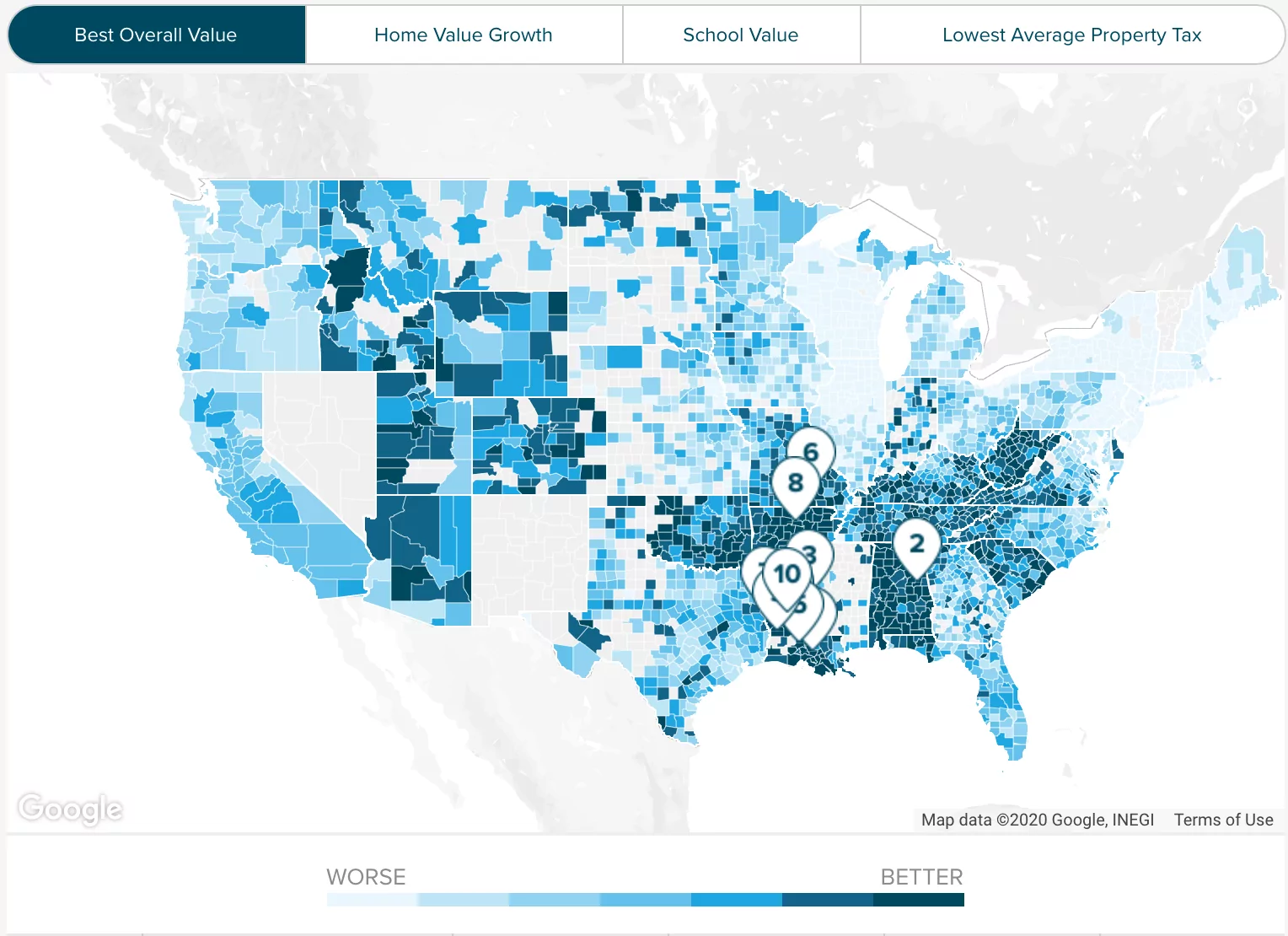

Property Taxes By State County Lowest Property Taxes In The Us Mapped